Value added tax calculation

Value-Added Tax VAT Calculator. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software.

Business Valuation Veristrat Infographic Business Valuation Business Infographic

The VAT Act requires most businesses and.

. Output VAT It is a tax charged on the sale of goods. Tax is calculated based on the value addition and not on the sale value. Value Added Tax Calculator Home Business VAT VAT Calculator This calculator makes it easy to quickly calculate VAT on a sale.

5 of the tax due and a late payment interest of 1 per month on the unpaid tax until the tax is paid in full. The Value-Added Tax VAT Calculator can determine a price before VAT a VAT rate or a price that is VAT inclusive. Value-added tax or VAT is a tax imposed on the sale of goods and services.

We want to add VAT to the net amount to get the gross. You sold the goods for INR 750 lakhs and the output tax is payable at 10 of the total income. Companies whose taxable supply exceeds 375000 dirhams USD 102180 must be registered.

This article provides a detailed guide to value-added tax for companies operating in the Philippines. The VAT calculator enables you to enter a list of amounts and have the VAT calculated for each of the amounts and a grand total off all the VAT amounts is. According to local law value-added tax VAT calculation formula is quite simple.

It is charged on the selling price of the goods. Input VAT It is the tax paid on the purchase of goods. The summation method the deduction method and the credit method.

Value Added Tax VAT is a consumption tax levied on goods at every stage of the manufacturing process from labor and raw materials to the final sale. Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth. Net Before VAT Price.

Value-added tax VAT was introduced into the Indonesian taxation system from 1 April 1985. Typically your penalty is charged at 5 of the unpaid VAT at the time of assessing your penalty. Lets consider that the net price of our sales is 100000frs and our VAT is 1925.

The calculation of the tax base for VAT is determined by the date that was earlier. Electronic Tax Invoice The VAT Electronic Tax Invoice. Our Value Added Tax Calculator will calculate the amount of VAT included in gross price and the amount you should add to a net price.

Lets understand Value Added Tax with the help of a multi-stage product manufacturing of Television Set which. It is charged at rate of 0 9 and 15. It is determined by calculating the difference between allowable purchases and revenue.

Penalty on late payment. We can use three methods to calculate the VAT liability. This means you paid INR 50000 as the input tax.

It is paid at the cost price of the. There are currently plans to raise the standard VAT rate to. Compare Tax Preparation Prices and Choose the Right Local Tax Accountants For Your Job.

The amount of VAT paid by the user is. Value Added Tax VAT is a tax on spending that is levied on the supply of goods and services in Fiji. Value Added Tax was introduced in 1973 as a replacement for Purchase Tax and Selective Employment Tax as a condition of UK entry into the European Economic Community.

Partner with Aprio to claim valuable RD tax credits with confidence. Use our VAT calculator to work out your VAT. For instance if you have an outstanding VAT payment of 1000 you will be.

Ad Well Search Thousands Of Professionals To Find the One For Your Desired Need. General VAT rate is ten percent. VAT Value Added Tax Calculator.

A value-added tax VAT or goods and services tax GST is an indirect tax in Europe Japan and many other countries on spending on goods and services. It is as follows. You can check items that are exempt of outside the scope of VAT here.

Simply enter the sale amount the local VAT rate the select. Enter values for two out of the three available inputs to compute the third value. Just enter your figure and choose whether you want VAT added or.

Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. Therefore the output tax is INR. The tax base in most cases is equal to the cost of goods and services sold taking into account.

Thus value-added as the basis of value-added. The formula to be used is 1VAT percentage X the net.

Automatic Tax Calculation Tax Creative Professional Accounting

Weighted Average Cost Of Capital Wacc Cost Of Capital Accounting And Finance Finance Investing

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

Simple Interest Vs Compound Interest Top 8 Differences To Learn Simple Interest Compound Interest Maths Solutions

Value Added Tax Explained What Is Vat And How To Calculate It Place Card Holders Value Added Tax Add Tax

Accounting Services In Dubai And Audit Services In Dubai Accounting Services Audit Services Accounting Firms

How To Calculate Vat In The Kingdom Of Saudi Arabia Vat In Uae Goods And Services Registration

Differentiate Between Vat And Sales Tax In 2022 Sales Tax Differentiation Tax

Sa302 Tax Calculation Request Form Self Assessment Tax Request

Vat Registration Threshold Calculation In Uae Vat Consultants In Dubai Uae Tax Debt Indirect Tax Seo

A Guide To Understanding Value Added Tax Vat Certified Accountant Accounting Education Supplies

Ev To Ebitda Meaning Formula Interpretation And More Enterprise Value Money Management Advice Learn Accounting

Download Saudi Vat Payable Calculator Excel Template Exceldatapro Excel Templates Templates Calculator

Vat Vs Gst Infographic Simple Flow Chart Infographic Goods And Services

Value Added Tax Vat Infographic Value Added Tax Ads Tax

Download Revenue Per Employee Calculator Excel Template Exceldatapro Excel Shortcuts Metric Excel Templates

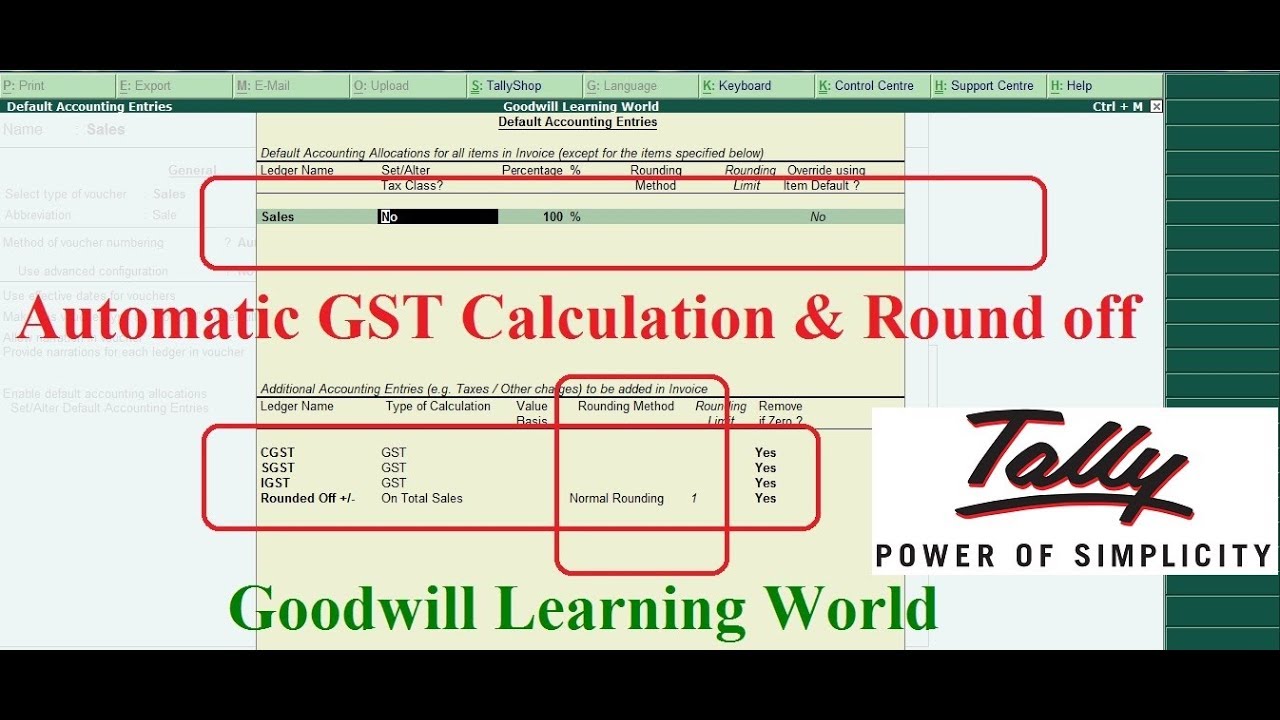

Tally Advance Configuration Auto Round Off And Auto Gst Calculation In Tally